Report Overview

- Understand the latest market trends and future growth opportunities for the Industrial X-Ray Inspection Systems industry globally with research from the Global Industry Reports team of in-country analysts – experts by industry and geographic specialization.

- Key trends are clearly and succinctly summarized alongside the most current research data available. Understand and assess competitive threats and plan corporate strategy with our qualitative analysis, insight, and confident growth projections.

- The report will cover the overall analysis and insights in relation to the size and growth rate of the “Global Industrial X-Ray Inspection Systems Market” by various segments at a global and regional level for the 2010-2027 period, with 2010-2021 as historical data, 2021 as a base year, 2022 as an estimated year and 2022-2027 as forecast period.

Description:

- In the post COVID-19 business landscape, the global market for Industrial X-Ray Inspection Systems estimated at US$563.4 Million in the year 2020, is projected to reach a revised size of US$874.1 Million by 2027, growing at a CAGR of 6.5% over the period 2022-2027.

- Digital, one of the segments analyzed in the report, is projected to record 7% CAGR and reach US$698.5 Million by the end of the analysis period. Taking into account the ongoing post pandemic recovery, growth in the Film segment is readjusted to a revised 4.6% CAGR for the next 7-year period.

- The Industrial X-Ray Inspection Systems market in the U.S. is estimated at US$190.1 Million in the year 2020. China, the world`s second largest economy, is forecast to reach a projected market size of US$83.1 Million by the year 2027 trailing a CAGR of 8% over the analysis period 2020 to 2027.

- Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 5% and 6% respectively over the 2020-2027 period. Within Europe, Germany is forecast to grow at approximately 6% CAGR.

MARKET DATA INCLUDED

- Unit Sales, Average Selling Prices, Market Size & Growth Trends

- COVID-19 Impact and Global Recession Analysis

- Analysis of US inflation reduction act 2022

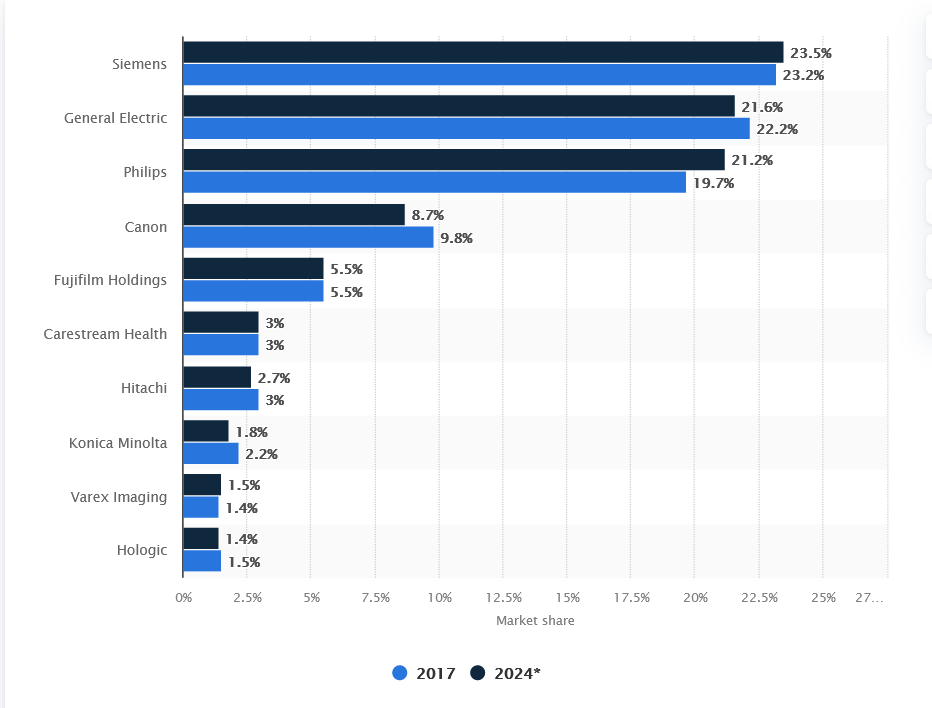

- Global competitiveness and key competitor percentage market shares

- Market presence across multiple geographies – Strong/Active/Niche/Trivial

- Online interactive peer-to-peer collaborative bespoke updates

- Market Drivers & Limiters

- Market Forecasts Until 2027, and Historical Data to 2015

- Recent Mergers & Acquisitions

- Company Profiles and Product Portfolios

- Leading Competitors

The Industrial X-Ray Inspection Systems Report Includes:

- The report provides a deep dive into details of the industry including definitions, classifications, and industry chain structure.

- Analysis of key supply-side and demand trends.

- Detailed segmentation of international and local products.

- Historic volume and value sizes, company, and brand market shares.

- Five-year forecasts of market trends and market growth.

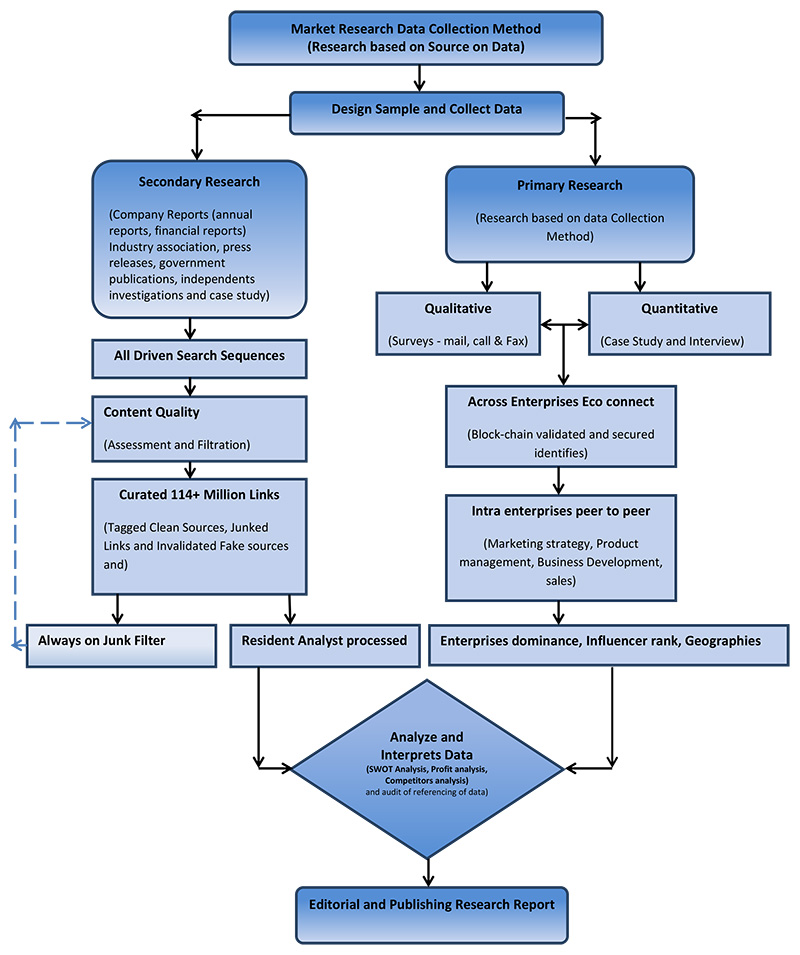

- Robust and transparent research methodology conducted in-country.

- Qualitative and quantitative analysis of the market based on segmentation involving both economic as well as non-economic factors.

- Provision of market value (USD Billion) data for each segment and sub-segment.

- Analysis by geography, region, Country, and its states.

- A brief overview of the commercial potential of products, technologies, and applications.

- Company profiles of leading market participants dealing in products category.

- Description of properties and manufacturing processes.

- marketed segments on the basis of type, application, end users, region, and others.

- Discussion of the current state, setbacks, innovations, and future needs of the market.

- Examination of the market by application and by product sizes; utility-scale, medium scale and small-scale.

- Country-specific data and analysis for the United States, Russia, China, Germany, United Kingdom, France, Japan, Israel, Saudi Arabia, South Korea, United Arab Emirates, Canada, Switzerland, Australia, India, Italy, Turkey, Qatar, Sweden, Spain, Belgium, Netherlands, Norway, Singapore, Egypt, Denmark, Austria, Vietnam, Brazil, Argentina, Mexico, South Africa, and others.

- Coverage of historical overview, key industrial development and regulatory framework.

- Analysis of competitive developments, such as contracts & agreements, expansions, new product developments, and mergers & acquisitions in the market.

- A look at the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders.

Reports Scope and Segments:

| Report Attribute | Details |

| Market size value in 2021 | USD 601 Million |

| Revenue forecast in 2027 | USD 874.1 Million |

| Growth Rate | CAGR of 7% from 2021 to 2027 |

| Base year for estimation | 2021 |

| Historical data | 2015 – 2021 |

| Forecast period | 2022 – 2027 |

| Quantitative units | Revenue in USD million and CAGR from 2021 to 2027 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, trends, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth InitiativesCOVID-19 Impact, Market Growth Trends, Market Limiters, Competitive Analysis & SWOT for Top Competitors, Mergers & Acquisitions, Company Profiles, Product Portfolios, Disease Overviews.

Market Size, Market Shares, Market Forecasts, Market Growth Rates, Units Sold, and Average Selling Prices. |

| Segments covered | Product, Component, Technology, Application, Region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East and Africa and rest of the world |

| Country scope | United States, Russia, China, Germany, United Kingdom, France, Japan, Israel, Saudi Arabia, South Korea, United Arab Emirates, Canada, Switzerland, Australia, India, Italy, Turkey, Qatar, Sweden, Spain, Belgium, Netherlands, Norway, Singapore, Egypt, Denmark, Austria, Vietnam, Brazil, Argentina, Mexico, South Africa, and others. |

| Key companies profiled | 3DX-RAY Ltd; Ametek, Inc.; Anritsu Corporation; Aolong Group; Baker Hughes Company; Bosello High Technology; Carestream Health Inc.; Carl Zeiss X-ray Technologies; CEIA S.p.A.; DanDong Huari; Eriez Manufacturing; General Electric Company; Glenbrook Technologies; Ishida Co., Ltd.; Loma; Maha X-ray Equipment Private Limited; Mekitec; Mesnac; Mettler Toledo International Inc.; MEYER; Minebea Intec GmbH; Multivac Packaging Machines; Nikon Metrology NV; Nordson DAGE; North Star Imaging Inc.; Nuctech Company Limited; OSI Systems Inc.; SANYING; Sartorius; Sesotec GmbH; Shimadzu Corporation; Smiths Detection, Inc.; TECHIK; Teledyne DALSA; Test Research, Inc.; Thermo Fisher Scientific; Thermo Fisher Scientific Inc.; Toshiba IT & Control Systems Corporation; UNICOMP; Viscom AG; VisiConsult X-ray Systems & Solutions GmbH; Vision Medicaid Equipments Private Limited; ViTrox Corporation; VJ Technologies; YXLON International; Zhengye Technology and others |

| Customization scope | Free report customization (equivalent up to 10 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Report Format | PDF, PPT, Excel & Online User Account |

Industrial X-ray Inspection System Market, by Component

- Hardware

- Software

- Support Services

- Consumables

Industrial X-ray Inspection System Market, by Imaging Technique

- Digital Imaging

- Digital Radiography

- Computed Radiography

- Computed Tomography

- Film-Based Imaging

Industrial X-ray Inspection System Market, by Dimension

- 2D X-ray Systems

- 3D X-ray Systems

Industrial X-ray Inspection System Market, by Vertical

- Electronics & Semiconductors

- PCB Inspection

- Solder Joint Inspection

- Wafer Inspection

- Automated Optical Inspection

- Other Applications

- Aerospace

- Aircraft Maintenance

- Composite Material Analysis

- Automotive

- Public Infrastructure

- Airport Security

- Railway Tracks

- Bridges and Tunnels

- Power Generation

- Nuclear Power Plants

- Renewable Energy Plants

- Non-Renewable Energy Plants

- Oil & Gas

- Subsea Pipeline Monitoring

- Transmission Pipeline Monitoring

- Storage Tank Monitoring

- Refinery Plant Monitoring

- Food & Beverages

- Manufacturing

- Product Quality Control

- Additive Manufacturing

- Plant Health Monitoring

- Other Verticals

Key Market Players

3DX-RAY Ltd; Ametek, Inc.; Anritsu Corporation; Aolong Group; Baker Hughes Company; Bosello High Technology; Carestream Health Inc.; Carl Zeiss X-ray Technologies; CEIA S.p.A.; DanDong Huari; Eriez Manufacturing; General Electric Company; Glenbrook Technologies; Ishida Co., Ltd.; Loma; Maha X-ray Equipment Private Limited; Mekitec; Mesnac; Mettler Toledo International Inc.; MEYER; Minebea Intec GmbH; Multivac Packaging Machines; Nikon Metrology NV; Nordson DAGE; North Star Imaging Inc.; Nuctech Company Limited; OSI Systems Inc.; SANYING; Sartorius; Sesotec GmbH; Shimadzu Corporation; Smiths Detection, Inc.; TECHIK; Teledyne DALSA; Test Research, Inc.; Thermo Fisher Scientific; Thermo Fisher Scientific Inc.; Toshiba IT & Control Systems Corporation; UNICOMP; Viscom AG; VisiConsult X-ray Systems & Solutions GmbH; Vision Medicaid Equipments Private Limited; ViTrox Corporation; VJ Technologies; YXLON International; Zhengye Technology and others.

Recent Developments

- One of the key market players in X-ray inspection systems, HEUFT SYSTEMTECHNIK GMBH launched a new pulsed X-ray technology that provides maximum detection capability in a limited space.

- A prominent market player in advanced detection solutions, Peco InspX Corporation developed a new solution to effectively detect vent tube fragments.

- October 2019 – ULC partnered with Nikon to launch a EUR 4.8 million prosperity partnership, which aims to combine new techniques to gain more information from X-rays, improving disease detection and industrial testing. The five-year initiative is funded by the Engineering and Physical Science Research Council (EPSRC), and is anticipated to put the UK at the forefront of X-ray imaging (XRI), which plays an important role in a range of sectors and industries, from medicine to security, manufacturing, aerospace, and cultural heritage.

- June 2019 – Baker Hughes, a GE company, planned to open a new Customer Solutions Center (CSC) in Silicon Valley for its Inspection Technologies (IT) business. The BHGE Silicon Valley CSC, located in San Jose, Calif., may bring BHGE’s most advanced non-destructive testing technologies under one roof. The BHGE Silicon Valley CSC is likely to provide customers for X-ray and computed tomography (CT) machine demonstrations, application development, industrial inspection services, and training.

After Sales Support

- Every updated edition of the report and full data stack will be provided at no extra cost for 24 months.

- Latest 2021 base year report.

- Free Updated edition of 2023 without any hidden cost.

- No user limitation for the report. Unlimited access within the organization.

- Unrestricted post-sales support at no additional cost

- Free report customization (equivalent up to 10 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

- Global Industry Reports will support your post-purchase for a period of 24 months to answer any of your queries related to the following market and to provide you any more data needed, for your analysis.

- Option to purchase regional or some selected Chapters from the report.